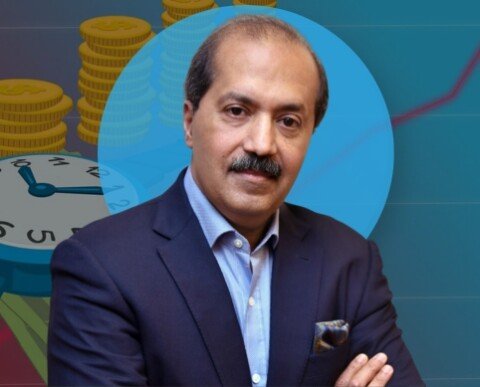

Zoho CEO Sridhar Vembu recently made a powerful call to action for India’s tech industry, urging a shift in focus from short-term valuations to sustainable growth. In a series of tweets, Vembu laid out his vision for Indian companies aiming to achieve “$100 billion in revenue,” not just valuation, to drive the nation’s economic progress. He emphasized that the key to lifting millions out of poverty and making a meaningful economic impact lies in generating consistent revenue, rather than obsessing over valuations.

Vembu cautioned against the dangers of over-prioritizing immediate stock valuations or relying on loose funding, both of which can distract businesses from building long-term value. He explained that valuation should naturally follow from doing things right, learning from mistakes, and maintaining financial discipline. When valuation becomes the primary focus, it loses its true significance, a concept illustrated by Goodhart’s Law, which highlights that when a measure becomes a target, it ceases to be a good measure.

“Can we develop IT firms from India that generate $100 billion in revenue, not valuation? If we are to improve the lot of our people, India needs a lot of them. China has produced many world champions in the past 20 years. The constant emphasis on valuation will not lead us there. “Visionary dreamers and long-term builders who strike a balance between their long-term goals and short-term financial restraint are what will get us there,” Vembu said.

The Zoho CEO further explained that stock bubbles often derail the real goal by shifting focus to optimizing stock prices in the short term. A loose funding environment also hampers discipline, as companies fail to learn how to manage their finances effectively. He stated that true growth and success come when businesses maintain focus on sustainable practices and avoid the temptation of chasing temporary valuations.

Many users on social media agreed with Vembu’s perspective, noting that India’s startup landscape often prioritizes rapid growth and high valuations at the expense of long-term value. Some pointed out the challenges faced by Indian startups, which lack the financial resources and supportive infrastructure available to China’s tech giants like Alibaba and Tencent.

One user remarked, “India should not replicate China’s growth story but should carve out its own, focusing on a value system that empowers the workforce. Unlike China’s top-down approach, India has the opportunity to build a model that balances economic growth with human dignity, sustainability, and social equity.”

Another commented, “Focusing on $1 million ARR (Annual Recurring Revenue) companies is a more sustainable approach. Valuations and fundraising may attract attention, but they don’t guarantee long-term success.”

A third user echoed the sentiment, saying, “I completely agree. Valuation without a long-term vision is the biggest problem. Unicorn status should only be pursued with a long-term outlook.”

Vembu’s vision for India’s tech industry challenges the traditional emphasis on quick valuation gains and encourages a focus on long-term growth and sustainable revenue models. By shifting the focus to lasting value, India’s tech companies can drive real economic progress and contribute to the global digital landscape, positioning themselves as world leaders in innovation.