On December 20, Oliviero placed 900,000 shares into an irrevocable trust for his minor children. This transfer was carried out without any cost, and Oliviero does not have investment authority over the securities within the trust. As a result of these actions, Oliviero continues to hold ownership of 2,294,583 shares of Checkpoint Therapeutics (NASDAQ: CKPT). Subscribers to InvestingPro can unlock further insights, including eight additional key investment strategies and in-depth financial health metrics for CKPT.

Other recent news reports have highlighted a number of noteworthy advancements pertaining to Checkpoint Therapeutics. At $0.18, second-quarter earnings per share exceeded both company and consensus projections. Additionally, a recent offering helped the business raise an extra $12 million.

The results of Checkpoint Therapeutics’ cosibelimab trial were equally encouraging, with objective response rates exceeding earlier findings. The Biologics License Application for cosibelimab has a Prescription Drug User Fee Act goal date of December 28, 2024, determined by the firm.

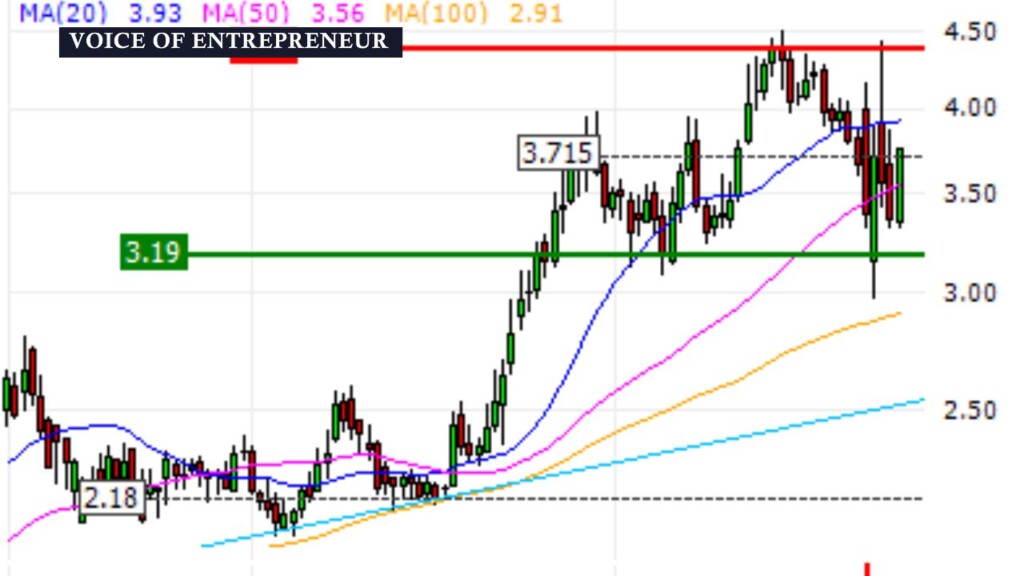

Lake Street Capital Markets reiterated its Buy rating for Checkpoint Therapeutics, raising the price target from $4 to $7. The company projected continued growth through 2025. Similarly, H.C. Wainwright reaffirmed its Buy recommendation, emphasizing the promising market prospects for cosibelimab.

A cooperation with GC Cell to assess the combination of their cancer medicines and a stock sale anticipated to raise about $12 million were the other major announcements made by Checkpoint Therapeutics. These are some of the latest advancements in the continuing immunotherapy and targeted oncology initiatives of Checkpoint Therapeutics.