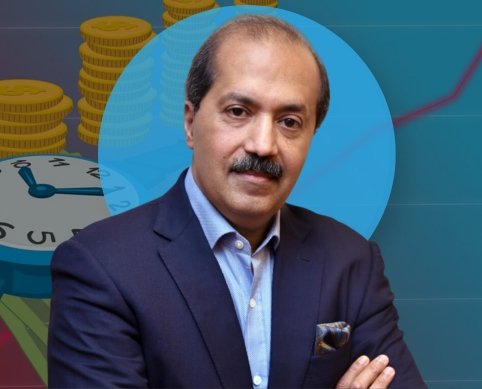

Startups face challenges because founders often become too confident and are unwilling to accept critical feedback, says veteran investor and Sorin Investments founder Sanjay Nayar.

When asked about the struggles of well-known startups like Byju’s, once India’s top edtech company, and Paytm, which had the potential to be India’s Alipay, Nayar explained that founders sometimes feel invincible.

“There’s a sense of overconfidence that creeps in, where founders think, ‘I know everything. I’m in control. Don’t question me,’” Nayar said, highlighting a major reason behind the difficulties these companies have recently encountered.

This mindset frequently results in a failure to pay attention to important criticism. “You hear, but you don’t listen,” he added, noting that those close to the founders frequently hesitate to share unpleasant news or to criticize their choices.

To emphasize the importance of honest communication between investors and founders, Nayar continued, “The ecosystem around them doesn’t want to give them bad news; it doesn’t want to question them.”

Paytm and Byju have both had substantial difficulties recently, each with unique problems.

Once the $22 billion startup industry darling of India, Byju’s has been mired in a string of legal disputes and scandals as it battles accusations of financial mismanagement. The edtech was criticized for going on an aggressive acquisition binge that resulted in debt overload.

Paytm has been struggling to bounce back since February when the Reserve Bank of India (RBI) shut down its banking division due to compliance issues. Additionally, Paytm’s 2021 IPO faced public backlash, with many reports labeling the share price as “expensive,” which led to a significant drop in its value.

Don’t market ahead of yourself. Prakash

Prakash and Nayyar talked about the difficulties these companies encountered.

He emphasized that, before going public, a solid business plan is required.

Prior to going public, you should be certain about whether your primary business model is developed and well-fitting for your product to the point that you can see a clear route to growth rather than having to keep coming up with new ones as you go. You can’t present yourself to the public with that mindset.

Prakash also cautioned against making purchases that deviate from a business’s core goals. His question, which was probably a reference to Byju’s ambitious expansion strategies, was, “Are those acquisitions leading to coherence in your business model, or is it distracting you?”

Prakash also emphasized the significance of aligning marketing with product readiness. He advised against marketing before your goods, stressing the need to make sure that promises and actual delivery match.