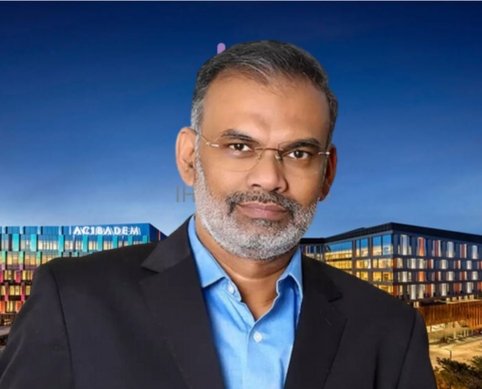

IHH Healthcare CEO Prem Kumar Nair shared with CNBC-TV18 in an exclusive interview that there are currently no plans to reinstate the Initial Public Offering (IPO) of Agilus Diagnostics, which was previously put on hold earlier this year.

Nair stated that IHH had encouraged Fortis to acquire the private equity stake when the IPO plans were abandoned. He confirmed that there are no immediate intentions to revive the IPO.

Instead, IHH has decided that Agilus will become a subsidiary of Fortis Healthcare, allowing the company to focus on integrating its diagnostic services with its hospital operations, thus creating a comprehensive healthcare ecosystem.

In August, Fortis Healthcare repurchased over 31% of its stake in Agilus Diagnostics after private equity investors exercised their put option. This buyback increased Fortis’s ownership in Agilus from over 57.68% to 89%.

The private equity investors involved included IFC with approximately 7.6%, Jacob Ballas with 15.86%, and Resurgence PE with 8%. This transaction, valued at over ₹1,700 crore, is anticipated to be funded through non-convertible debentures (NCDs) issued by Fortis.

Nair emphasized that diagnostics are crucial to hospital operations and noted that the company’s strategy is shifting from the consumer segment to focus on hospital labs, reference labs, and advanced diagnostics to support oncology. Regarding Agilus’s underperformance compared to its peers, Nair mentioned that this year has been a period of consolidation, with operational metrics already showing signs of improvement.

The CEO of IHH Healthcare also pointed out that while Agilus may not pursue monetization through an IPO, it remains an essential component of IHH’s integrated healthcare vision, aimed at bolstering its expanding oncology and other specialized services.